Using the Bob Proctor Paradigm Shift helped me to become a multi-millionaire at age 30. This changed my life and something I learned from Bob Proctor has to do with making more money and the perception behind that. And it was something I was struggling with that I didn't even know I was struggling with. I realized it's how you're conditioned. You are conditioned this way and it's keeping you broke and you don't realize it.

Reprogram Your Subconscious Mind By The Bob Proctor Paradigm Shift

Lucky for me, I was able to have a phone call with one of my mentors, Bob Proctor. And he said, do this, and that, you're doing this. This is what's wrong. So I followed what he said, and it changed my life. And made me a millionaire by the time I was 28, then I was a multimillionaire, by the time I was 30. I'm gonna break that down in this video so that I can help you.

Because over the last 24 months, government shutdowns declare people non-essential a lot of people have lost their jobs and many are struggling financially. And I don't want you to be one of them. I think this is gonna change your life and change your bank account. It's my free success. Hypnosis to reprogram your subconscious mind. So you can check that out in the description and pin it to the comments. Let's dive, write into this Bob Proctor money advice that made me a millionaire.

How Did I Gain Financial Freedom?

All right. So I'm making this video because a lot of people were asking, well, like how do I get more money? They would wonder how do I make more money? How do I have more freedom? Like, help me with that. And you know, I'm certainly not Jeff Bezos, but by the time I was 30, I was able to have a liquid net worth of over 3 million and have multiple businesses and no debt.

I am retired and enjoying life. When I met my wife, we were 20, 21. Both of us were broke. She was in credit card debt because she was spending more than she was making, cuz she wasn't earning very much. And I just kind of thought I'd always basically be broke or just be over broke. I was reasonably happy, right? So I would say things like money, isn't everything. And at least I'm happy as if there was some type of, consolation prize and being broke.

The Struggle Was Real

And I got to a point where I wanted to change that. The reason that I got to that point is that my wife and I weren't married yet, but we were living together and it was like a $1,200 apartment that we were renting in Hollywood. And every month was so stressful when it would become time for rent. Ashley was working over 40 hours a week at a clothing store and she was commuting in traffic at least an hour each way. It's Los Angeles. It was Hollywood.

So, you know, a lot of times it was much worse than an hour commute. She's exhausted when she comes back and we're barely scraping by. I said when she comes back and we're barely scraping by and she's in credit card debt, my career hadn't taken off. So I wasn't making regular money. I had just got my first book contract, but you only get paid once every 12 months.

Bob Proctor Paradigm Shift - Meeting The Best Mentor

So we were stuck and I wanted to change that. And through a lot of synchronicities, I met a mentor named Bob Proctor. A lot of people have heard of him. He's probably one of the best prosperity teachers out there. And I was to Bob and Bob said this phrase that changed my life. He said, "Don't lower your standard of living to meet your income, raise your income, to meet your standard of living".

And that's what most people do. That's how we're conditioned in our world because by and large, all of our habits are reactions or patterns, whether it has to do with money or not. But specifically money. We live in a reactionary state of consciousness and reactionary behaviors. So we constantly lower our standard of living instead of raising our income. And it seems easier said than done.

Money Is Just A Reward

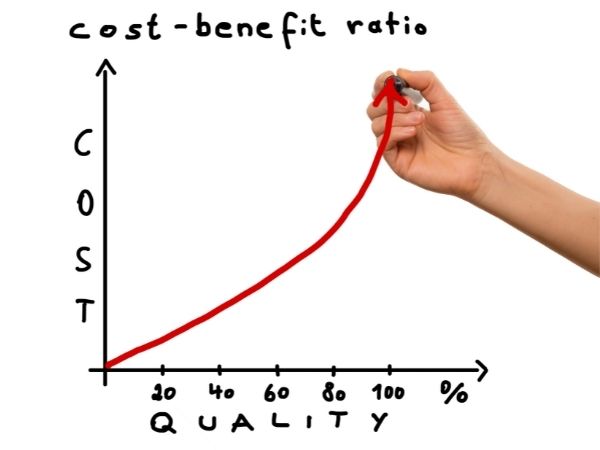

It's like, well, if it was that easier, I would've already done it. It, but it's about moving out of reaction and into creation because the fact is that wealth has to do with ratios and percentages. Not with digits when I was broke, I always thought wealth had to do with digits. So it'd be like, oh, that's a thousand dollars rent. Oh yeah, that's way too much. I couldn't afford it.

What do I do? And all I was doing was reacting. And I finally had to go, well, do I wanna spend my whole life fitting my standard of living into a little box because I don't control my income, or do I want to change that belief take 100% responsibility for my and figure out how to change it. Like, I didn't even know how do you make money? And I found out that money is a reward for service rendered and you are paid in direct proportion to the value that you provide to the marketplace of needs. The market of needs is that people pay for things because they need them. Whether it's food, whether it's a massage, whether it's consulting, whether it helps with marketing, they need something. So they're willing to pay for it. You are solving somebody's problem. And I realized the reason I was broke wasn't because money was that hard.

Start Looking At Things As Ratios

Since I have now a semblance of financial freedom, everything I look at has nothing to do with digits. And it has to do with percentages or ratios of my monthly or annual income. When I was broke, I spent 50, 60%, 70% of all my income on living expenses. Now that I have money, I spend, I don't know, five, 10, 15% max. And I lived a good life doing that. Well, what change instead of reacting to the digits that are in your bank account, you have to move to a creative state of consciousness and you have to start looking at things as ratios.

It is not any harder to make $10,000 a month than it is to make 2000. They're both equally hard and they both equally have their sacrifices and they both equally have their own difficult and easy E things. But both of them are equally hard. It's not much harder to go from $2,000 to $10,000, but you have to change who you are, how you think and how you, how you perceive money, and the habits that you have around that.

Don't Lower Your Standard Of Living

And so I sat there thinking about what Proctor said to me about the Bob Proctor Paradigm Shift, don't lower your standard of living, which is mostly what most people do. They just keep lowering their standard of living to meet their income. So they're always living like an animal in a state of reaction. And that's who I was. I was just basically like a deer, in the headlights. What do I do?

What do I do? And all I was doing was reacting. And I finally had to go, well, do I wanna spend my whole life fitting my standard of living into a little box because I don't control my income, or do I want to change that belief take 100% responsibility for my and figure out how to change it. Like, I didn't even know how do you make money? And I found out that money is a reward for service rendered and you are paid in direct proportion to the value that you provide to the marketplace of needs.

The market of needs is that people pay for things because they need them. Whether it's food, whether it's a massage, whether it's consulting, whether it helps with marketing, they need something. So they're willing to pay for it. You are solving somebody's problem. And I realized the reason I was broke wasn't because money was that hard.

The Problem Is Not How Much Things Cost

The reason I was broke is that I was reacting instead of growing, I wasn't solving very many people's problems and I wasn't thinking creatively about how to solve those problems at all. I was just saying, well, money's not everything. At least I'm happy. It's harder than people think, you know, 500 bucks is a lot. You know what I would, I wish things were different. It's the system. That was how I thought. So if you wanna change your financial life, you have to realize that the problem isn't how much things cost.

The problem is your inability to earn more money. And it seems almost like, oh, I was this ridiculous guy, but there's always going to be an increase in the cost of living. As long as we have a Fiat currency system because it relies on them pumping more debt into the monetary system, into a debt-based monetary system.

And when you print money back by nothing, everything else that you can buy with money goes up in price. Why we're seeing a huge jump in inflation. And regardless of whether the government tries to promise you, they're gonna get it under control. They can't, it's impossible unless the monetary system changes, which it probably won't anytime soon. And so what am I saying here is that there's always going to be an increase in the cost of living.

You Might Be On The Wrong Income-Earning Roadmap

So if you continue to lower your standard of living to meet your income or your purchasing power, cuz all income is, is your purchasing power. And if you continue to lower that you will always be a cog in the wheel. So then what has to happen? You have to realize a couple of simple things. And number one is you might be on the wrong income-earning roadmap, cuz all of this is just condition.

We don't need to make it the fault of the, you know, uh, of the new world order or, or the system or you don't need to blame the education system. Let's just take responsibility. Somebody else may have made you subconsciously, but it's your responsibility to change it.

Bob Proctor Paradigm Shift - Start Reprogramming Your Subconscious

So the very first thing is to start reprogramming your subconscious, just for wealth. The chances are you've been programmed for, for, for being broke. We're just getting by. That's why 80% of people live paycheck to paycheck. The average American can't come up with $500 in 24 hours for an emergency. What is this showing us? Almost everyone we interact with is struggling financially. So all of those patterns we've inherited, whether they're behaviors or perceptions and beliefs, uh, whether there are certain ways we perceive and, and, and interact with money, it's all been programmed by other people. So the first step is to start to hypnotize yourself.

I have free success hypnosis it's right there down below it's Jacob hypnosis.com. It's in the description and pin to the comments. It's life-changing about a million people from all over the world have used it. Don't download it yet though. Keep watching this video because this video really can change your life. And I don't say that arrogantly. I say it because it changed my life. When I finally learned this stuff from Bob.

Bob Proctor Paradigm Shift - Look At How You Earn Your Money

So the first part is, is starting to, to begin to reprogram yourself. So my hypnosis is there. And then the second part is to look at how you earn your money because we're conditioned in our world to be robots, right? So, if the premise is to raise your, to meet your standard of living, instead of lowering your standard of living to meet your income, they're two different things, right?

Just like if you were playing, let's say you were a boxer, right? Floyd Mayweather became such a great boxer because he was so good, at avoiding punches, right? He was like the best defender ever. So other boxers just think they can just keep taking hits, right? They aren't moving. They're two different, they're two different game plans. They're two different strategies.

You could be the person that takes all the punches in the face from society and you constantly react and you go, well, I'll just lower my standard of limit. Money's not everything. Or you could raise your standard of living. And the first thing is, are you busy? If you're not busy, you could probably be doing things that could increase your income at least gradually. Right? And stick with me here, cuz this seems basic, but gradually increasing your income.

So that's the first thing that I did. Step number three is gonna be very, this is the thing that made me a multimillionaire, but let's stick with step number two first though, step number one to start to reprogram the subconscious. Somebody else may have made you, but it's your responsibility to change it. Somebody else may have made your financial behaviors, but it's up to you to change them. Right? And that's my success. And then number two is to look, take inventory of your financial roadmap. And if your day is open with Netflix and your day is open with having drinks with friends and your day is open with shooting them with your buddies and your day is open scrolling the internet. Then if you're honest with yourself, you'll find out why you don't have enough money. And that's what I found out. I loved ease.

I loved ease. So I was always broke. I'd sleep in as late as I possibly could. Then I'd just go walk in the sun all day, you know, listen to an audiobook, come back, hang out, read a little bit. I always did the bare minimum and it served me for a while. But then I realized my life was constrained cuz Ashley and I wanted to go to Canada in the summer, but I couldn't afford it. Ashley and I wanted to go to Hawaii. Couldn't afford it. Ashley and I wanted to go on a trip. Couldn't afford it, needed a second car. Couldn't afford it. So I finally realized, okay, I got a problem here. I guess I'm gonna lower my standard of living. And that's when Bob said no, no, no, no, no. Do not do that. Raise your income

To meet your standard of living. Come that down below, raise your income to meet your standard of living. Do not lower your income, raise your income to meet your standard of living. So the first thing that I started doing was filling as much of my time with anything that was an income-producing task. A lot, a lot of times our day goes by very quickly. A lot of things happen. We feel like we're busy or doing stuff, but a lot of that day is traded doing low-income tasks or no income-producing tasks. So I started filling up as much of the slots of my day, as I possibly could with anything, whether it was pitching a high school to let me speak for 500 bucks, whether it was helping someone that wanted to be an author because I had self-published the first book. I sold my first 10,000 copies.

I was quote, kind of successful in books, but I wasn't making any money. I'd done a TEDx talk. I had been on local TV a bunch of times and I pitched myself for everything. So I had skills well in the marketplace of needs, you have to reflect on your skills and then start providing value to individuals. So I said, well, what are my skills? Well, I self-published my first book. I sold 10,000 copies and 95% of books don't sell 2,500 copies in a lifetime. So I'd done pretty well at my first self-published book, even though I wasn't making good money or anything, I had done more than 95% of authors. I learned how to because I couldn't afford a publicist. I learned how to pitch myself for media. So I had things to tee each people. This was eight, 10 years ago when people started self-publishing was just becoming popular.

So I started selling consulting to people that wanted to learn PR marketing, how to get their books, um, self-published and out there, how to get how to, I started pitching myself to spiritual churches, to unity churches on Sundays. Anything I could then I started filling my time with farmers markets and I'd get a table for 15 bucks next to someone selling kale. I would stop everyone for the six-hour farmer's market. Every time they walked by and I would try to sell them my book list price 1495. If I could sell it to you for that, I would, if you said no, then I'd start lowering the price. I'd sell it for as low as five bucks. So I just started doing things that were positively moving the direction of my income. That's what you have to do. Focus on income-producing activities. Albert Einstein said nothing happens until something moves.

Nothing happens until something moves money. Doesn't come until you move until you show up for it. But most people never show up for it. They just keep lowering their standard of living or just accepting their life circumstance. You see what I mean? As soon as you accept your life circumstances and you just try to constantly shrink your standard of living or you just try to constantly manage what you have. Um, you're stuck that way. You and, and, and by the way, before we get on number three, just a side note. If you make the same amount of money every year, you're going backward. So the federal reserve just said, inflation is 7%. We all know. It's like more like 20, 25. That means you are getting a 20 to 25. Let's just call it 10%. Let's say inflation is 7%. That means if your income is increasing by 10% per year, you're going backward.

So if you make, for even numbers 40,000 a year, you are losing. If inflation is 10%, you are losing four grand in purchasing power every single year, year over year. So in fact, you have to be growing. Otherwise, you're gonna backward, which is crazy to think about. So then step number three, I got the wheels rolling, right? You can get the wheels rolling. You get my success hypnosis, it’s free. Number two is you don't accept your life circumstances and you start somewhere. Bob Marley said, used to say, if you don't start somewhere, you never get anywhere at actually, uh, started selling art. She had never sold art before, but she always wanted to be an artist when she was a kid. And we just said, look, let's try to save our first $10,000 together. You know, I thought that was a reasonable goal and we just started everywhere.

We could Ashley. That's how my wife began. These awesome wood burnings that she did. We just started somewhere. That's what we did. And you have to start somewhere with income-producing tasks because nothing happens until something moves. And then number three is your income earning roadmap.

3 Ways To Make Money

There are three primary ways to make money. One is to trade your time for money. So if you trade your time for money, you could get better at what you do and increase your fees. But there's a point at which you can't increase your fees anymore. And there are only so many hours in a day. Then number two is to, uh, actually start to remove yourself from the equation, right? And that would be a business where you are not directly trading your time for money infinitely. It's changing your model in which you're earning income so that you raise the ceiling on how much you can make in 24 hours or how much you can make in 365 days.

Bob Proctor Paradigm Shift - Investing Money To Earn Money

Number three is investing money to earn money, but let's focus on you taking inventory on your income earning roadmap. And this woman was daunting for me because I dropped outta college. And I always thought of myself as a creative person, not a money person, not a numbers person. I didn't think of myself as an entrepreneur. I thought of myself as an artist. I was a book writer. That's what I was. And so when I realized there was a limit on how much money I could earn trading my time for money, doing book consulting.

When I realized there was a limit on how many high schools would let me speak, first of all, cause I was a called dropout. And second of all, because there are only five days in a week. There are only so many hours in a day. When I realize that, then you get to a place where you can accept the reality and you stay where you are. And this is what most people do.

Think Of Everything As A Business

And the best way to think about this I found was for me to realize I was in two businesses. Think of everything as a business. Even if you work as a cashier at a grocery store, think of it as a business, you are your own business. You are your corporation. You are your entrepreneur and you're making X amount of dollars doing X job. Just think about it as a business instead of a job. Well, to change your income-producing map, you have to be in two businesses.

This is why most people earn the same amount of money every single year. It hardly ever changes. Maybe a couple of percent bump in, in a bonus. But remember if you get a 4% bonus a year, but inflation is 7%, you got a 3% pay decrease and this is why it's important to be growing. And so I was intimidated by number three. So I want you, to think about this with me is if you raise your income to meet your standard of living, you're probably gonna want multiple sources of income.

One that provides the current cash flow and two is the better income-earning model or just a second stream of income. And, and if this sounds like, stick with me, I was, I, if you can learn it, I can learn it. I was, I was the dumbest person that I knew. I failed junior English class in high school. Um, I dropped out of college. Um, my mom wrote all my S T papers to get me into college. Cause I didn't even wanna write 'em and do 'em. I didn't want to go to school.

Build A Different Income-Earning Road Map

What I realize was that I had to change my roadmap, my ceiling. I had to raise my ceiling on income because I could only trade my time for money for so much for consulting and speaking. So I started changing my model. I was doing seminars and things like that. So instead of running seminars, instead of doing speeches, I put together at first, very cheap online courses, 20 bucks, 30 bucks, I started putting stuff together that once it was made people from all over the world could buy it at any time. I didn't have any way to sell those because I didn't have a brand. I didn't have a YouTube channel. I didn't have a website. I didn't have any of that, but I built a different income-earning road map. It's kind of like if you're driving to Los Angeles from Las Vegas, there's the old Las Vegas highway and it's dirt.

And that was the old highway. Or you could go on the I 15, they're two different maps. One of them is going to they're two different roads. One of them is gonna get to, to where you want to be quicker and faster and more fit. It's the same thing with how you earn your income. And so remember don't lower your standard of living to meet your income growth so you can raise your income to meet your standard of living.

Money is a direct reward for the value you provide to the need, to the marketplace of needs. When people need things, if you provide value, eventually you will be compensated for them. If you are good at it and you can market and sell it and get it in front of people, it's easier than you think. Remind yourself. It's easier than I think it's just as hard to be broke and stay where I am and give up as it is to push forward.

Move Confidently In The Direction Of Your Goals

And, uh, fulfillment comes from the progress of moving confidently in the direction of your, of your goals. And so I started putting together online courses. I realized it would be much more effective if instead of trying to do high school speeches everywhere. Um, I started making YouTube videos. Then I could make a video once and 365 days later, somebody could find it. It was more scalable.

It was more, there was more leverage to that income-earning roadmap, even though there wasn't any money immediately. So I started making videos. I didn't get any progress, but I kept doing my existing job, my existing career, my existing business, and the mistake that a lot of people make are you might be tempted to just quit your job right away. You're like, well, this I'm on the wrong map. I need to quit right away. Don't quit your job.

Don't Quit Your Job Or Business, Use It To Start Saving

Don't quit the business that you're in. Now use it as an investor to start saving as much of that money as you can. So you're not stressed when you leap. There are all these like life coaches and motivational channels. And there's like, quit your job today. Go in there, write the place on fire, kick your boss's desk over and tell 'em to screw himself. Right?

And I think it's much more effective to realize you're in two businesses, one for now, and one for the future, or if you can't con, if you can't conceive of the idea of a business, cuz you're in a job, you're in two jobs, the one you're in now and the one you would like to be in. So I realized I had my time for money, the existing income model. I did that the best I could. I put as much time into it as I possibly could.

I stacked as much cash as I possibly could. And then I started to build my online courses. I started to build my YouTube channels and I didn't get any progress. And I, it took me about a year. I almost quit many times because YouTube's harder and people think it is the videos don't go viral. And everybody quits because you don't get any progress. But eventually, um, which is a whole another story.

Your Income-Earning Roadmap Will Keep Changing

One of my videos finally went viral. I mean, I never looked back. I started getting hundreds of thousands of website visitors a month from basically every country in the world. I started to get customers from every country in the world. People started telling me what they needed, what they wanted, what they wanted help with. And I started serving them the best I could. And slowly my income-earning roadmap kept changing, kept changing.

New businesses would come, new ideas would come. And I started branching out in a bunch of different businesses, but it started because I realized I was in two businesses. So take inventory of how you earn your money, take inventory of how you earn your money and then ask yourself, how can I add more leverage and more scale to this? How can I in the marketplace of needs, solve more people as problems. You probably have something people need, you probably can solve some problem.

Keep Improving Your Skills

Everything is problem-solving, whether it's plumbing, whether it's accounting, whether it's a financial investment, whether it's teaching people about, um, whether it's, uh, therapy, um, whether it's, uh, uh, parenting stuff. Um, whether it's ballet, whether it's golf, you have some skill of some sorts that if you focus on it, you can get better and better and better and better and better at it and provide more value to people.

So you start reading psychology books, you start reading sales and marketing books. You start reading money books instead of saying, well, I'm just broke. It's the system. If I vote for Trump or I vote for Bernie or I vote for Hillary, then things will change. Well, I need them to change because if you think other people are the reason that you're broke or you think the world or the system is the reason that you're broke, you're gonna have to change the whole world or the whole system before your financial life can ever get better, which is impossible.

And it's a play of words of a Wayne Dyer. He used to say, “If you think other people are your problem, you're gonna have to send the whole world to the psych before you can ever get better. And that was what I realized my life was based on sending it. I needed everyone else to go to the psychiatrist. I needed the financial system to change and the banking system to change. And I needed people to respect and appreciate that. I was young, cuz I used to always think, well, I'm too young to make more money. So I never tried that harder. I don't know. I didn't know anything about business. I didn't know anything about YouTube. I didn't know anything about the internet. I would just say, I don't know how

To flip the question and say, how can I earn more money and just quietly, sit there with the answers and start writing them all down. Well, you could maybe you're good at making cookies and you could build, I mean, shoots Annie's that organic company. I mean they started making cookies. Maybe you sell cookies at farmer's markets. Maybe you sell real estate, but you could do 30% better. Maybe it's gardening. Maybe it's ballet. Maybe it's golf. You have a skill. Maybe it's just providing more value to the company you work for.

And you down with the boss, you say, I want to earn more money. I realize you shouldn't pay me more money unless I help more. How can I provide more value to you? How can I provide more value to the company? And how can I provide more value to the customers? All of a sudden you've shifted from reaction to, oh my financial life is stuck like this. It's just the way it is. I need to conserve. I need to constrain. You shifted to creativity. You shifted the prosperity. You've gone from, this is the way it is to, I can change it. And when that starts to happen, that's when the light photons that are all your bank account is a bunch of light photons. That's when the light photons start to shift.

Focus On Your Personal Growth

And then if you continue to focus on your personal growth, you continue to do the mindset work. Right? I talked about my free success hypnosis, take a step today to ensure that you make more money. A lot of people watch this video and they'll take zero steps to ensure they make more money afterward. So no out of this works. So leave a comment. I tried this, none of it works. You don't understand. My mom did this thing when I was 11 and I was born in the wrong place. And it's easy for you too right? That's there'll be people that do that and I can guarantee they will be broke again. Why can I guarantee that I'll always be broke if I think like that because I've given up my power to change my financial life. I've given it up. So don't lower your standard of living to meet your income, raise your income, to meet your standard of living.

So the first is to set a clear goal. How much money do you want to earn in a month? How much money do you want to earn in a month? And then what's your plan of action to do that? Take inventory of your existing roadmap, move from constraint and conserving to how can I produce more? Because production is abundance. Production is creativity. And the more you produce, the more you are financially rewarded.

And if you save the difference between what you produce and what you consume, you build capital, you build wealth. And, and to the degree that you focus on producing and providing more value to the marketplace of needs is to the degree, you will see the digits and come in your bank account, the zeros continue to grow.

Start Thinking Of Money As Ratios

So I know that this is a long video, but I invite you to just stop thinking about money as digits and start thinking of it as ratios thousand dollars is only expensive, uh, relative to where you are, everything is relative, right? I said, at the beginning of this video, I got a couple of million-dollar net worth. Um, it's nothing relative to many people

And it's maybe a lot to other people. Well, similarly, so your rent, that's stressing you out that, that, you know, a new call cause your old car's beat up and you can't afford the new car. Stop saying it's a lot of money

And start shifting your, your ratios. It's only a lot of money cuz you haven't learned how to make 10 K a month or 20 K a month or 50 K a month or a hundred K a month or a couple of hundred K a month. And you can learn that skill. It's a, just like anything else. And it starts with buckling your seatbelt, putting your hands on the steering wheel, and actually giving it a, giving it a swing and giving it a hack. But most people never give it a swing. They never give it a hack. They just go, well, if Trump was in, if Bernie was in, if Hillary was in, if the system changed if those people weren't so greedy, it's just the way it is. If I was born differently, if I had a different skin color, if I wasn't so fat, if I wasn't so skinny, if my mom was nicer, if I had a better childhood, if I went to a better school, if I knew more skills, if I had more time, but they go, I'm never gonna be able to make more. So let's just conserve what we have and then they go, well, money isn't everything.

Money Can Hear You When You Call It

Why would you say that? I believe money has ears. And it hears when you call it, money has ears. And here's when you call it, most people never call it. So comment that down below money has ears. And it hears when you call it, come that down below money as ears. And it hears when you call it, why do I say money as ears? And it hears when you call it, most people never call money into their life cuz they never believe they can get it. That's the whole idea of lowering your standard of living to meet your income.

They never call it in cuz they don't even think they can get it. So they crop. They psych themselves out before they ever even give it try money as years in it. Here's when you call it. So I hope you enjoy today's video. I was just trying to provide as much value as I can. This is something that changed my life. Once I shifted my thinking and I realized the problem wasn't things are expensive. The problem is I don't make enough money. I can't control the cost of things. You cannot control the cost of things. You can't, you can try, but you can't,

You Can Control How Much Money You Make

But you can control how much money you make. Maybe not in a week, but you can certainly control it in 365 days. It's a shift in mindset to realizing that you have creative solutions and just like learning to cook as a skill. So is money. The world's conditioned us that so much more money, so much more complex. We can debate why that is, why we're conditioned that way. But just the fact is we are, but Jim Marone said, what's easy to you do is easy not to do.

It's hard to be broke. It's also might be hard to double or triple your money, but you can do it. So pull out a pen and pad, write that goal down for yourself. Take inventory of your current income-earning models. Make a list of some of the ways you can increase your income immediately by 10%, 15%.

And don't forget to brainwash yourself before the world brainwashes you. There are a lot of people that work hard, right? And you think, well, this isn't a video just telling you to work hard. There's a video telling you to change. It's a video explaining how I changed the way I thought about myself and about money and how to earn money. I changed the way thought. And when I changed the way I thought I changed the way I behaved.

And when I changed the way I behaved, I had different actions, those thoughts, those behaviors, and those actions produced different financial results. I wasn't supposed to be a multimillionaire. By the time I was 30, I dropped outta college. I failed junior English class in high school. Like I didn't drop outta college. Cause I was like mark Zuckerberg. And I was like a genius. I dropped outta college cuz I hated it.

Overestimate What You Can Accomplish in 10 Years

I thought it was dumb and I couldn't study. I couldn't focus. I just didn't think it worked for me. And then in 10 years, I had a net worth of over 3 million with no debt. And it's like that old quote that Tony Robbins says a lot. Most people overestimate what they can accomplish in a year, but they underestimate what they can accomplish in 10. They overestimate what they can accomplish in one year financially. But they underestimate what they can accomplish in 10. Tony Robbins Training For Wealth is the best training that will guide you towards your life goals.

So if you overestimate what you can accomplish in one year, you go, I love this video. It made a lot of sense. I'm gonna sit and I'm gonna think about all these ideas. And then you work for a while, but six months you don't get a significant change and you stop. And then you go back to where you are and you go back to the old idea of I'm gonna lower my standard of living.

And that's what most people do. They get a little better and a little worse and a little better and a little worse and a little better and a little worse. So they move a little bit ahead and then they go right back and they stay like that, their whole lives. So I hope you enjoy today's episode. Be sure to check out my free success hypnosis right there down below it's jakeshypnosis.com.

Bob Proctor Paradigm Shift - You Have Total Control Over Your Financial Life

I hope this video makes you realize that you do control your financial life. Most people don't wanna believe that cuz they screw up so much. They need to blame how the world's unfair society because they defeat themselves so much. They spend more than they make. They take out credit card debt. They fool around in their spare time on, on Netflix and social media all day and gossiping and complaining.

And we're just staying where they are, right? Making excuses, whoa, money is in everything, you know, but you can change your financial life quicker, faster, and easier than you think. And probably be I didn't. I had no idea. I would create as much success as I did in 10 years. And it's relative. I know I haven't even tapped 1% of my financial potential one person. I know.

I know for a fact you haven't tapped 1% of your financial potential to, I know you could do better. I know you're smarter than you think. I know you're capable of more than you think. I know that you can rearrange your time, your life, your priorities, and your values and you can double your income. I know you can do it. And I want to challenge you to give it a try.

So if you enjoy this video, hit the like button subscribe, bell notification. A lot of people saying they aren't getting notified for my video. So make sure you hit the bell notification. Gimme a comment down below that says I control my financial life comment down below. I control my financial life. Get my free success hypnosis. It's right there down below it's Jacob hypnosis.com. It's pinned to the comment as the top comment. And it's in the description right there down below. A lot of people will watch the videos and they'll be like, well, this doesn't work well, take action. And today start to build a new mind, a new belief system about money, a new belief system about your future and what you're capable of.

And that starts with brainwashing yourself for financial this before your old habits brainwash you for more mediocrity. So check out Jacob osis.com right there down below in the description and pin to the comments. Hey, wishing you a great day. I'll see you in the next video. I'll help you enjoy it. Comment down below. Let me know where in the world you're coming from. And if you enjoyed this, I know sometimes you just want to go to the next video and I get that. But leaving a, um, means a world to me and I truly appreciate 'em and I read 'em all and I love to know where you're coming from and what you thought about this. So see you next time.